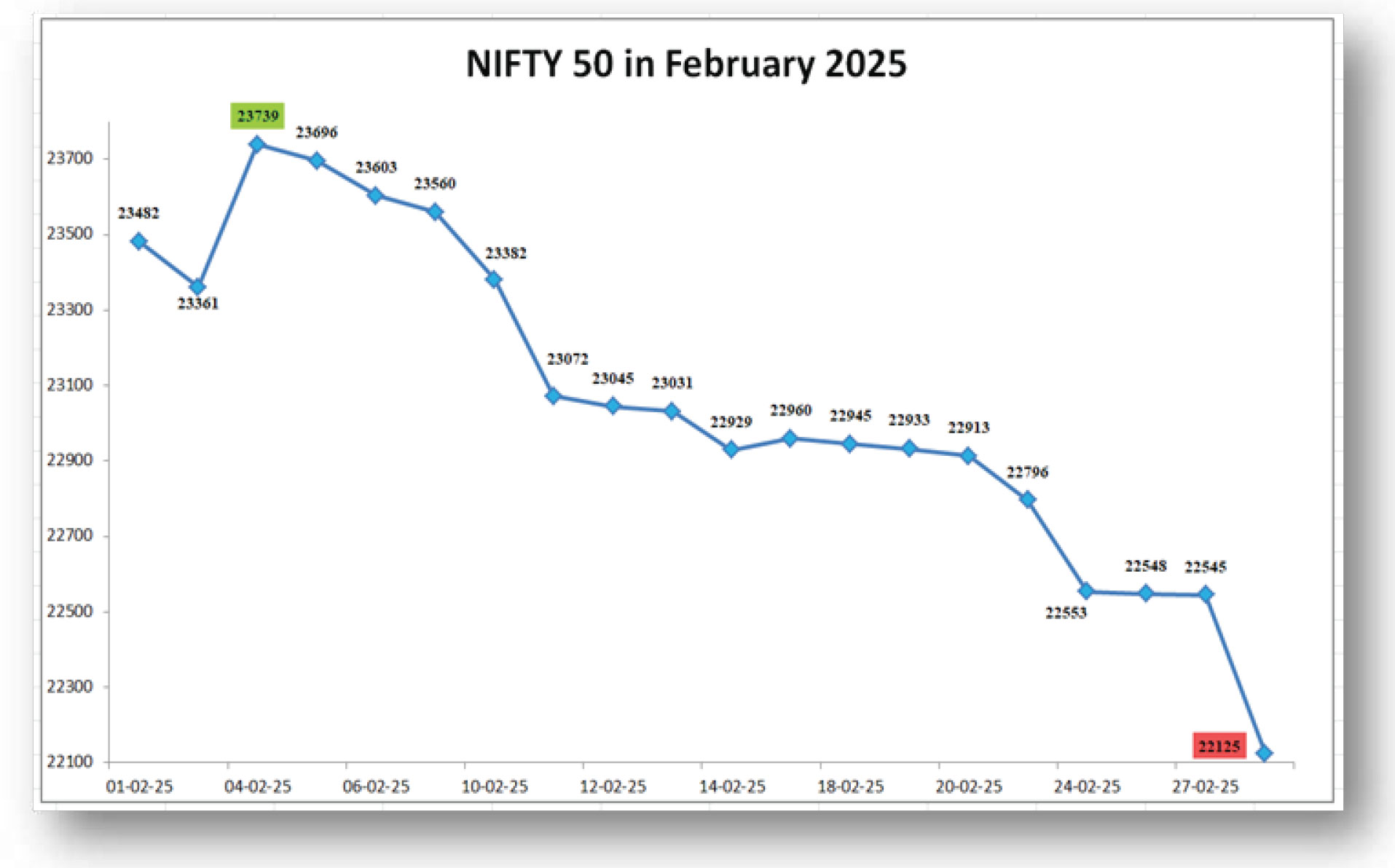

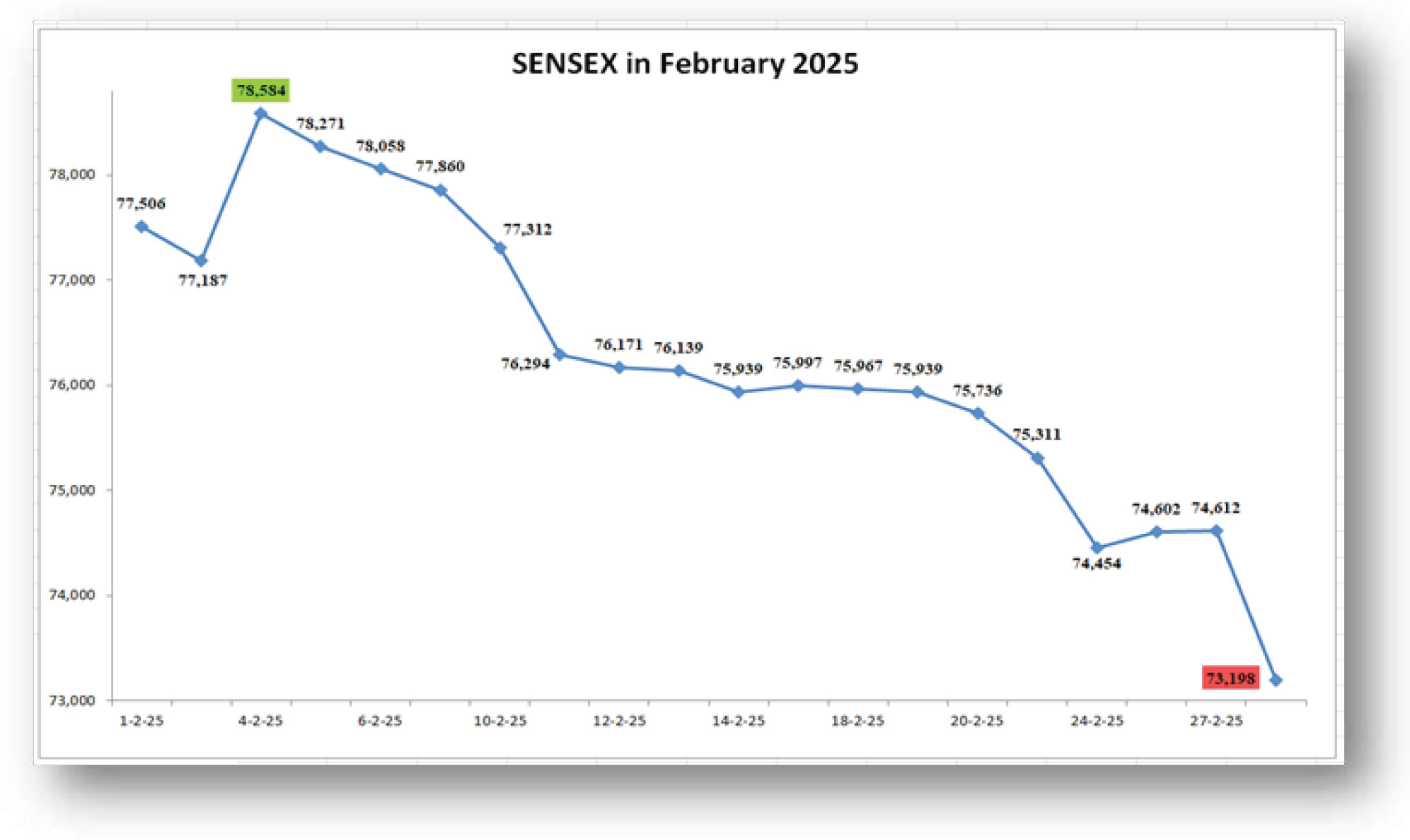

India’s stock market faced a sharp downturn on last day of February 2025, as the Sensex and Nifty 50 recorded their worst single-day decline in nearly five months. The NSE benchmark also marked its longest monthly losing streak in 29 years (since 1996), driven by heavy foreign capital outflows amid concerns over U.S. tariffs. The BSE Sensex plunged 1,414.33 points (1.90%) to close at 73,198.10, after hitting an intraday low of 73,141.27,

of only 0.82%. This decline was majorly driven by global economic worries, foreign investors pulling out funds, and disappointing corporate results. Small and mid-cap stocks faced heavy selling pressure. On February 28, 2025, the Indian equity market saw a massive erosion of ₹8.2 lakh crore in market capitalization as the Sensex plummeted by 1,414 points to close at 73,198.10, and the Nifty fell by 420 points to 22,124.70. From January down 1,471.16 points (1.97%). Meanwhile, the Nifty 50 extended its losses for the eighth consecutive session, dropping 420.35 points (1.86%) to settle at 22,124.70. Overall, both indices declined by 6% in February. Looking at the sectoral performance, Nifty IT Index suffered the steepest drop, falling by 4.18%, Nifty Auto Index declined by 3.92%, Nifty FMCG Index dropped by 2.62%, and lastly Nifty Bank Index showed some resilience with a decline to February 2025, the total market capitalization of listed companies on the Sensex fell from approximately ₹445 lakh crore to ₹393 lakh crore, resulting in a loss of over ₹50 lakh crore in market capitalization over the first two months of 2025. Thus, while the total erosion from January to February was over ₹50 lakh crore, the specific erosion in February was highlighted by a significant drop of ₹8.2 lakh crore on the last trading day of the month.

In February 2025, global trade wars triggered significant financial market volatility worldwide. The turmoil began when U.S. President Donald Trump announced tariffs on Canada, Mexico, and China, imposing a 25% tax on most imports from Canada and Mexico (excluding energy products) and a 10% duty on Chinese goods. This led to a sharp market reaction, with Asian indices in Hong Kong, Japan, and South Korea dropping by around 2%, while European markets also declined as Canada and Mexico retaliated. The renewed U.S.–China trade tensions, reminiscent of the 2018–2020 disputes, exacerbated global economic uncertainty, raising concerns over slower GDP growth, rising unemployment, Foreign Institutional Investors (FIIs) withdrew substantial funds from Indian markets during the month, driven by global economic uncertainties and shifting investment preferences. According to depository data, FIIs pulled out approximately ₹34,574 crore from Indian equities during the month, while other reports indicated that outflows exceeded ₹46,000 crore by February 27, bringing the total FII outflows for 2025 to ₹1.12 lakh crore. Several factors contributed to this trend, including escalating global trade tensions and concerns over U.S. tariffs, which heightened market volatility. Additionally, Indian equities were perceived as overvalued compared to other emerging markets like China, where lower valuations made investments more attractive. Weak corporate earnings growth in India further discouraged foreign investors, while strong economic indicators and a strengthening U.S. dollar drew capital toward American markets. China also emerged as a favoured investment destination due to its potential for economic recovery. Collectively, these factors led to a significant FII exodus from Indian markets in February 2025. Several domestic economic factors influenced Indian markets in February 2025. Slower GDP growth was a key concern, with India's economy expanding at a lower-than-expected 5.4% in the second quarter of FY25. However, a recovery to 6.2% in the third quarter, driven by improved rural consumption and increased government spending, provided some optimism. Inflation remained above the Reserve Bank of India's (RBI) comfort level, though strong agricultural output and government interventions helped stabilize food prices. Meanwhile, India's fiscal deficit widened to 74.5% of the revised target for FY25 by January, raising concerns about investor confidence and market stability. Domestic consumption played a crucial role, with robust rural spending supported by a strong agricultural sector, and festival-related demand further boosting economic activity. Additionally, increased government expenditure emerged as a key driver of growth in the third quarter, helping to offset weaker private investment. So in the month of February 2025, the Indian stock markets saw significant declines, extending the bearish trend that began earlier in the year. A key factors behind the downturn was the withdrawal by Foreign Portfolio inflation, and a stronger U.S. dollar. Specific industries faced substantial setbacks, including the automotive sector, where companies like Toyota and Nissan with operations in Mexico saw stock declines, and the technology sector, where Taiwanese firms such as Foxconn and Quanta suffered losses. In India, escalating tariff fears erased $180 billion from market capitalization within two days, with the Nifty Metal Index plunging 5.6% over three sessions due to the trade war’s impact on the metal sector. Overall, February 2025 witnessed heightened economic uncertainty and sector-specific struggles, leaving global markets reeling. Investors (FPIs), global economic uncertainties and sector-specific challenges. Looking ahead to March 2025, several factors are expected to influence market performance. Global trade tensions and volatility in major indices could continue to impact investor confidence, while a potential recovery in GDP growth and the Reserve Bank of India's (RBI) monetary policy stance may provide some support. Government infrastructure spending could further aid economic growth, while sectoral performance remains mixed—Nifty Energy and Metal sectors showed early resilience, whereas challenges persist in Nifty Auto and IT due to global factors and supply chain disruptions. Additionally, continued FII outflows could exert pressure on the market, though domestic institutional investors (DIIs) may offer some stability. Overall, March 2025 is expected to be volatile, with a potential rebound if investor sentiment improves and global uncertainties ease.

In February 2025, the Indian debt market remained stable amid key developments influencing its performance. The 10-year benchmark G-Sec yield held steady at 6.71% on February 27, supported by expectations of fiscal consolidation and potential interest rate cuts. Corporate bond yields for AAA and AA-rated securities showed minimal fluctuations, reflecting a stable market environment, though stress in the microfinance sector and increased risk weights on NBFC loans posed potential risks to borrowing costs and liquidity. The Reserve Bank of India (RBI) played a crucial role in maintaining stability through Open Market Operations (OMOs) to inject liquidity, while fully subscribed Treasury Bill auctions indicated strong demand. The Union Budget 2025-26 set a fiscal deficit target of 4.4%, with a slightly lower government borrowing plan than the previous year, further aiding market stability. Investment trends pointed toward corporate bond funds and dynamic bond funds as attractive options, given their potential for higher returns in a falling interest rate scenario. Overall, February 2025 saw a balanced debt market, characterized by steady G-Sec yields, cautious corporate bond conditions, and effective liquidity management by the RBI. There are several key factors which drove increased interest in fixed-income investments in February 2025. Higher yields compared to historical averages made bonds attractive to investors seeking stable returns amid market volatility. Anticipation of interest rate cuts by central banks, including the U.S. Federal Reserve, further supported fixed-income investments, as lower borrowing costs were expected to enhance bond returns. Global economic uncertainties, including trade tensions and policy shifts under the Trump administration, also pushed investors toward safer assets like bonds. In the high-yield sector, improved credit metrics and shorter durations made these bonds appealing to those seeking higher returns with manageable risk. Additionally, bonds played a crucial role in portfolio diversification strategies, particularly during periods of market stress, with the "Fed put" concept providing an implicit backstop for fixed-income markets. The Indian fixed-income market also benefited from strong domestic fundamentals, including a stable political environment, controlled inflation, and favourable demand-supply dynamics for government securities. The Indian debt market faced several challenges in February 2025, impacting liquidity, investor participation, and foreign inflows. Low liquidity in secondary markets remained a concern, as institutional investors preferred private placements over public issuances, limiting broader market participation. Public issuance accounted for only 2% of total corporate bond issuances in FY2024, highlighting barriers to expanding the market. Additionally, the India-U.S. bond yield spread narrowed to a two-decade low of 227 basis points, making Indian debt less attractive to foreign portfolio investors (FPIs). Rising global borrowing costs, driven by tightening monetary policies in developed economies, further discouraged foreign inflows. Sectoral stress also posed challenges, particularly in the microfinance sector and non-banking financial companies (NBFCs), where higher risk weights increased borrowing costs and tightened liquidity. These factors collectively contributed to a cautious outlook for the Indian debt market.

In February 2025, crude oil prices fluctuated due to global market dynamics, geopolitical factors, and trade uncertainties. WTI crude oil prices peaked at $71.85 per barrel on February 19, marking a 1.57% increase from the previous day, before declining to around $69.66 by the end of the month. Brent crude prices hovered around $75.84 per barrel on February 19 and averaged approximately $78 per barrel for the month, with the Indian Basket price recorded at $75.57 per barrel on February 27. Several factors influenced these price movements, including supply disruptions that initially boosted prices, though expectations of a resolution in the Russia-Ukraine war tempered the gains. Global trade tensions and economic uncertainties also weighed on oil prices. Additionally, U.S. sanctions on Russia led to an 11% decline in India's crude imports from Russia, prompting Indian refiners to seek alternative suppliers like Iraq. As a result, India's total crude imports dipped slightly to 4.82 million barrels per day in February, down from 5 million barrels per day in January. Overall, the month saw volatility in crude oil prices, driven by shifting global demand patterns, supply chain adjustments, and geopolitical developments. Crude oil price predictions for March 2025 were shaped by various factors, including supply and demand dynamics, geopolitical uncertainty, and global economic trends. The gradual phase-out of OPEC+ production cuts was expected to increase supply, potentially lowering prices, while rising production from non-OPEC+ countries like the U.S., Canada, and Brazil could lead to a surplus, exerting further downward pressure. However, geopolitical tensions in key oil-producing regions posed a risk of supply disruptions, which could drive prices higher. A slowdown in global economic growth might reduce oil demand, though signs of economic recovery in certain regions could offset this decline. Additionally, the growing adoption of renewable energy and electric vehicles, along with regulatory efforts to curb carbon emissions, was expected to influence long-term crude oil demand. Market volatility, driven by speculation, currency fluctuations, and production disruptions, also played a role in shaping price expectations. Considering these factors, predictions for Brent crude prices in March 2025 ranged between $70 and $80 per barrel, reflecting a complex and uncertain outlook

In February 2025, bullion prices in India saw notable fluctuations, with gold surging to record highs while silver experienced a decline. Gold prices jumped nearly 4% during the month, reaching a peak of ₹88,090 per 10 grams for 24K gold on February 25, while 22K gold hit ₹80,750 per 10 grams. Prices varied slightly across cities such as Chennai, Mumbai, Hyderabad, and Delhi but generally remained elevated. In contrast, silver prices declined by over 2.5% during the month, settling at around ₹97,000 per kilogram by the end of February, down from earlier highs. The surge in gold prices was driven by global trends and strong festive demand, whereas silver faced downward pressure, marking a contrasting performance in the bullion market. Gold prices surged to ₹86,831 per 10 grams for 24K gold, driven by geopolitical risks, inflation concerns, and increased investment flows. The depreciation of the Indian rupee against the U.S. dollar further contributed to the price rise. However, by the end of the month, gold prices corrected slightly to around ₹87,300 per 10 grams due to broader market dynamics and a stronger U.S. dollar. While high prices dampened jewellery demand, investment interest in gold remained strong, with significant inflows into Gold ETFs and the RBI resuming gold purchases in January. Despite this, India's gold imports fell to a 20-year low in February as record-high prices reduced demand. Global factors, including the U.S. Federal Reserve's interest rate decisions and geopolitical tensions related to tariffs, also played a crucial role in shaping price movements. Overall, February 2025 saw unprecedented gold price highs, followed by a minor correction, influenced by both domestic and global economic factors. Multiple factors are expected to influence gold prices in March 2025, with key drivers including monetary policy decisions, geopolitical tensions, central bank demand, inflation, currency fluctuations, and seasonal demand. Interest rate decisions, particularly by the U.S. Federal Reserve, will play a crucial role, as a rate cut could enhance gold's appeal as a safe-haven asset, whereas higher rates may strengthen the U.S. dollar and reduce gold's attractiveness. Additionally, monetary policies adopted by central banks in Europe and Asia will contribute to price movements. Geopolitical tensions, including trade wars and conflicts, could increase demand for gold as a safe asset, with any escalation further driving prices upward. Central bank demand remains a significant factor, as sustained purchases to bolster reserves amid geopolitical uncertainties could support higher gold prices. Persistent inflation and economic uncertainty may also lead investors to turn to gold as a hedge, especially in response to concerns about government borrowing and fiscal deficits. Currency fluctuations, particularly the strength of the U.S. dollar relative to other currencies, will impact gold demand, as a stronger dollar typically makes gold more expensive for foreign buyers. Additionally, cultural and seasonal demand in India, particularly during festivals and wedding seasons, could contribute to price increase.

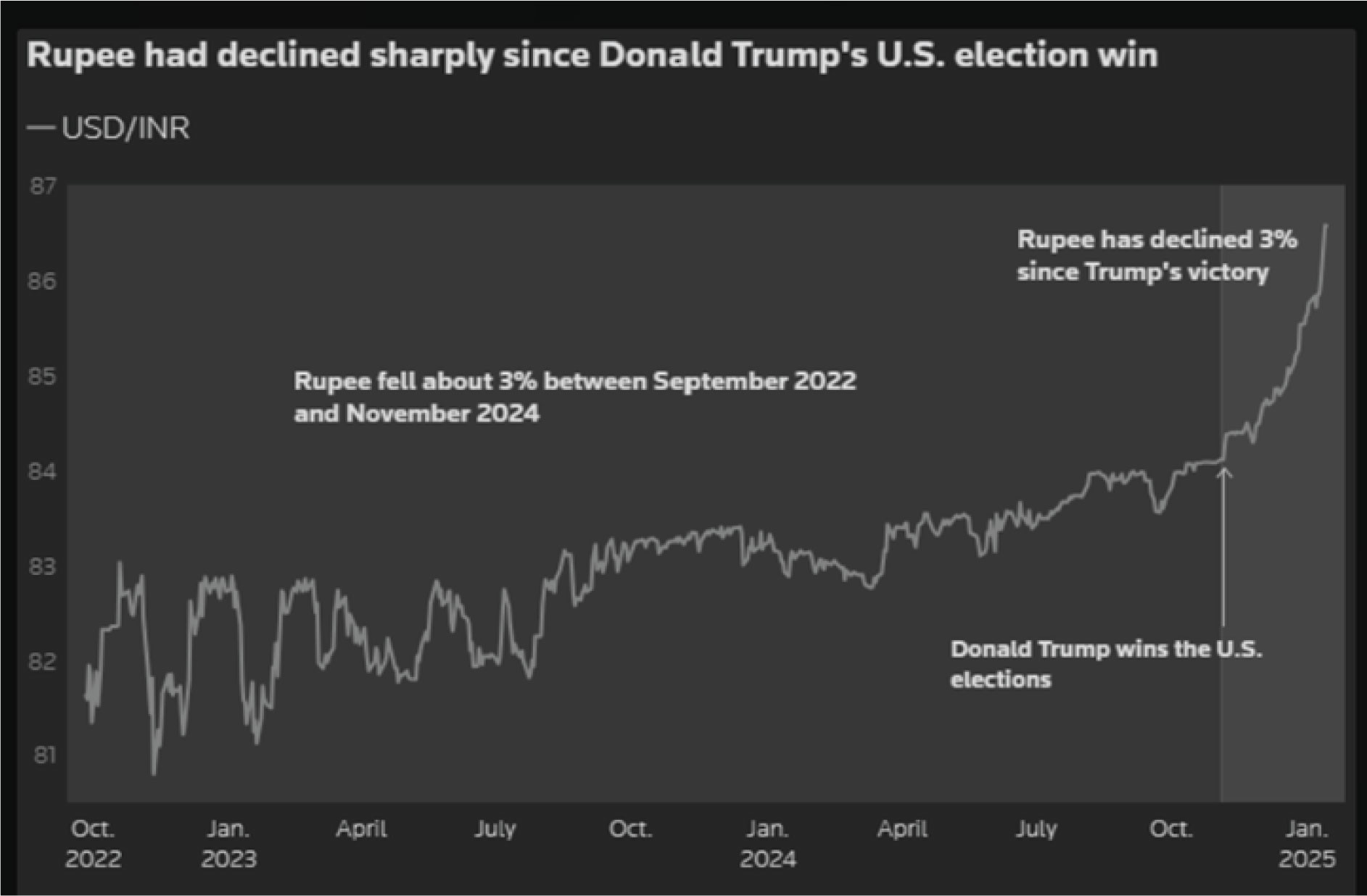

In February 2025, the Indian rupee experienced significant depreciation against the U.S. dollar, reaching an all-time low of ₹88.10 in early February, its weakest level ever. By the end of the month, the rupee had recovered slightly, trading at approximately ₹87.37 per USD, but still marking its fifth consecutive monthly decline. The Indian rupee's depreciation was driven by a combination of global and domestic factors. On the global front, the U.S. Federal Reserve's aggressive interest rate hikes made the U.S. dollar more attractive, leading to capital outflows from emerging markets like India. Geopolitical tensions, particularly the Russia-Ukraine war and trade conflicts, increased global risk aversion, prompting investors to seek safer assets such as the U.S. dollar. Domestically, India's widening trade deficit, fuelled by higher imports of crude oil and essential goods, put additional pressure on the rupee. Slower GDP growth projections and concerns over India's fiscal stability and rising public debt further dampened investor sentiment. Additionally, significant foreign institutional investor (FII) outflows from Indian markets since October 2024 compounded the rupee's weakness. The Reserve Bank of India's decision to allow more flexibility in the rupee's value under Governor Sanjay Malhotra also contributed to the currency's depreciation. Together, these factors led to the rupee's decline in February 2025. The Indian rupee is expected to continue its depreciation trend in March 2025, with potential levels reaching around ₹87 against the U.S. dollar. Key factors influencing the rupee's performance include global economic uncertainties, ongoing trade tensions, and U.S. tariffs, all of which are likely to contribute to volatility in the currency market. Additionally, the Reserve Bank of India's monetary policy decisions and interventions will play a critical role in managing the rupee's fluctuations and mitigating further depreciation

In February 2025, Indian mutual funds faced a difficult month, especially in the equity segment, due to market volatility and foreign institutional investor (FII) outflows. Most equity mutual funds posted negative returns, with 487 out of 542 funds experiencing losses, some as steep as 25%. However, funds like Parag Parikh Flexi Cap Fund, Motilal Oswal Multi Cap Fund, and Motilal Oswal Large Cap Fund performed relatively better, showing smaller declines than their peers. The Indian equity market was in a correction phase, driven by high valuations, geopolitical tensions, and sustained FII selling. On the other hand, debt mutual funds generally fared better, with corporate bond funds such as Axis Corporate Debt Fund and ABSL Corporate Bond Fund providing returns around 8%. Some credit risk funds, including BOI Credit Risk Fund and ABSL Credit Risk Fund, also delivered positive returns, though with higher volatility. Hybrid funds showed varied performance, with some proving more resilient than pure equity funds due to their diversified asset allocation. Overall, February 2025 was marked by significant challenges for equity mutual funds, while debt funds offered more stable returns, influenced largely by the market correction and FII outflows. The debt mutual funds generally performed better, offering stable returns, with medium-duration funds recommended for their potential to benefit from interest rate changes. Bond yields surged during the month, with the 10-year benchmark yield rising from 6.65% to around 6.85%, affecting debt fund performance. Despite the challenges in equity markets, systematic investment plan (SIP) inflows in February 2025 were expected to surpass the previous year’s figures, demonstrating resilience among retail investors. January 2025 saw a total of ₹26,400 crore in SIP inflows. As of January 31, 2025, the Indian mutual fund industry’s AUM stood at ₹67.25 trillion, although the AUM of equity funds may have decreased due to outflows and negative returns. Sector-wise, funds focused on technology, IT, pharmaceuticals, and healthcare showed resilience, benefiting from advancements in AI, cloud computing, and steady demand for healthcare services. Overall, while the equity segment faced significant challenges in February 2025, debt funds and SIP inflows provided stability, laying a strong foundation for long-term growth in the Indian mutual fund industry. Investors are advised to focus on diversified portfolios and long-term strategies as market conditions evolve.

In February 2025, the Indian insurance sector experienced notable developments, largely driven by key announcements in the Union Budget 2025-26. One of the most significant reforms was the increase in the Foreign Direct Investment (FDI) limit from 74% to 100% in the insurance sector, contingent on premiums being invested in India. This change is expected to attract considerable international capital and expertise, thereby boosting the sector's growth potential. The Budget also highlighted the enhancement of digital infrastructure, including the Central KYC registry and Bharat Trade Net, to improve customer onboarding and streamline international operations. In terms of growth, the non-life insurance sector saw a significant rise in premium income, particularly in health, motor, and crop insurance, supported by government initiatives such as the Pradhan Mantri Fasal Bima Yojana (PMFBY) and Pradhan Mantri Jan Arogya Yojana (PMJAY). Additionally, increased participation from private players, coupled with technological advancements and product innovation, contributed to the sector's rapid expansion. However, insurance penetration in India remains relatively low at 3.7%, compared to the global average of 7%, with factors like limited awareness and economic constraints continuing to pose challenges. Looking ahead, the sector is poised for substantial growth, driven by regulatory reforms, digital transformation, and expanded coverage for emerging segments like gig workers. Despite this, insurers will need to navigate increased competition and evolving customer needs. Overall, February 2025 was a transformative month for the Indian insurance sector, with the Budget's reforms laying the groundwork for heightened foreign investment and technological progress.

UAN ACTIVATION FOR EPF-LINKED INSURANCE:

Activate your UAN by March 15, 2025, to access

EPF-linked insurance benefits

TAX-SAVING INVESTMENTS:

Invest in tax-saving instruments under Sections

80C, 80D, etc., such as PPF, NPS, ELSS, and

tax-saving FDs before March 31, 2025, to claim

deductions in the current financial year

ADVANCE TAX PAYMENTS:

Ensure the fourth instalment of advance tax is paid

by March 15, 2025, to avoid penalties under

Sections 234B and 234C.

UPDATED INCOME TAX RETURN (ITR-U):

File or update your income tax return by March 31,

2025, if you missed reporting income or made

errors in previous filings.

MINIMUM INVESTMENTS IN

GOVERNMENT SCHEMES:

Ensure minimum annual investments in schemes

like PPF and Sukanya Samriddhi Yojana to keep

accounts active and avoid penalties.

SPECIAL FIXED DEPOSITS:

Invest in special fixed deposit schemes before

March 31, 2025, to secure higher interest rates.

BANKING SERVICES ON MARCH 31:

Utilize banking services for government

transactions, such as tax payments and pension

disbursements, as banks will remain open on

March 31, 2025

Copyright © 2021 Fintso