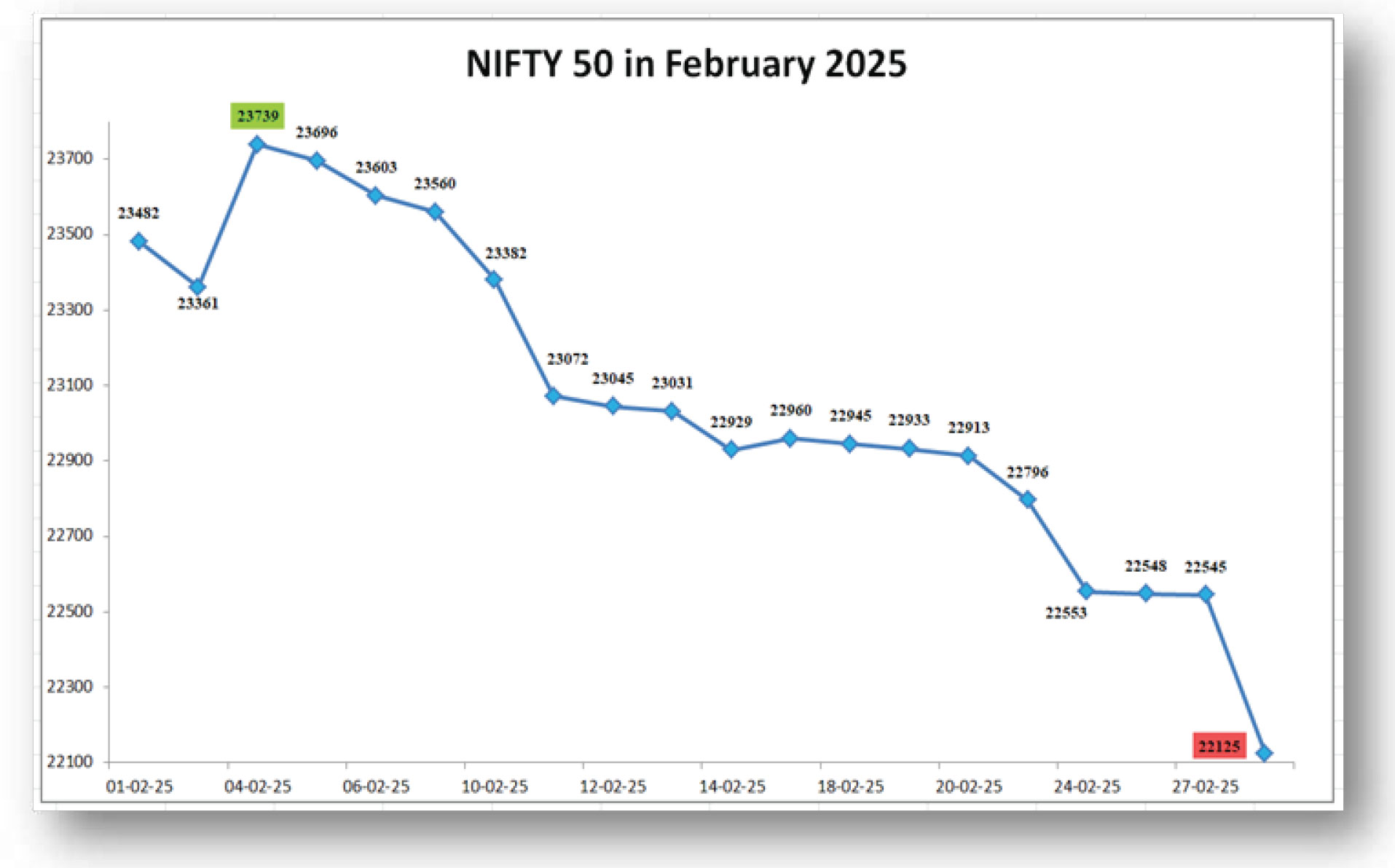

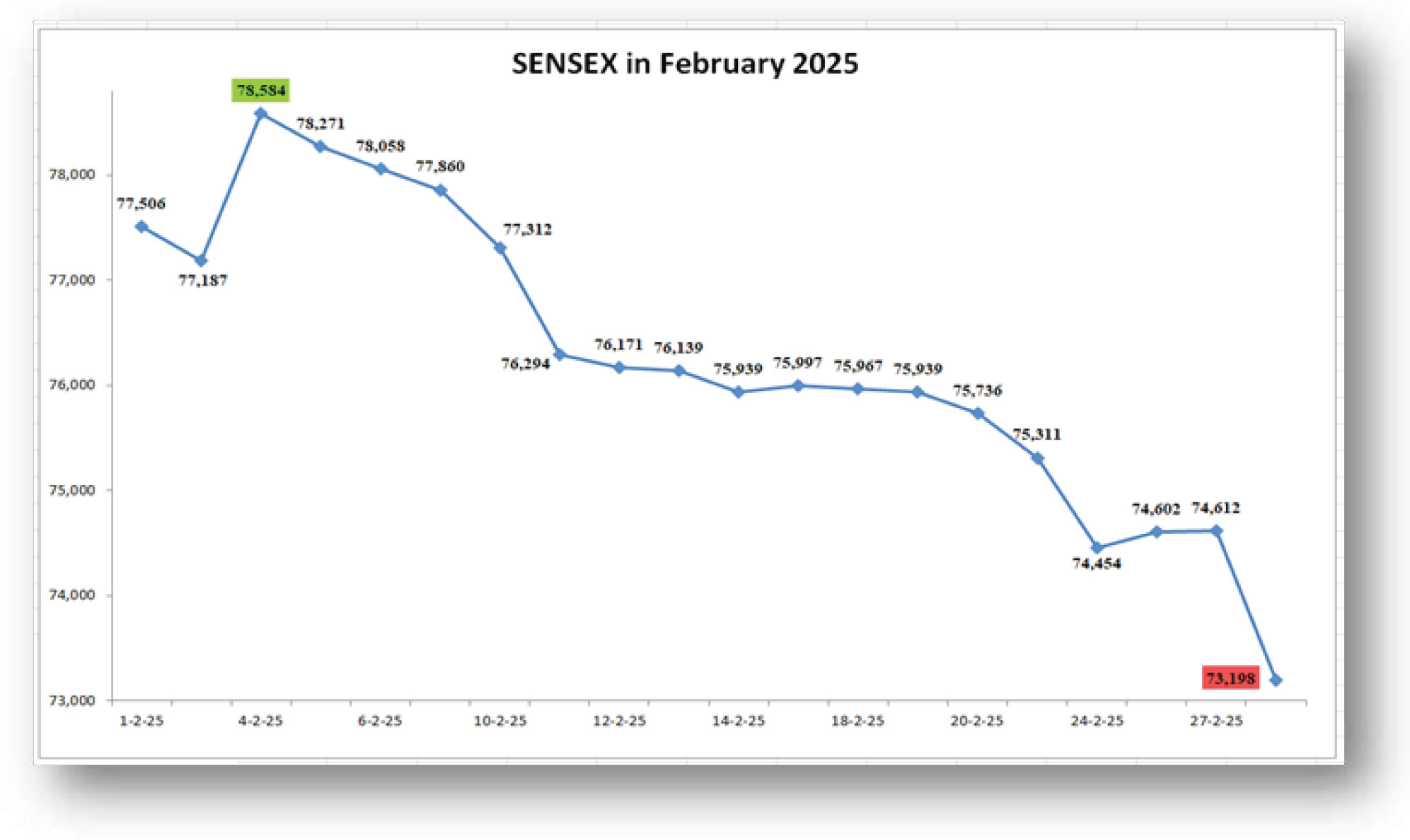

India’s stock market faced a sharp downturn on last day of February 2025, as the Sensex and Nifty 50 recorded their worst single-day decline in nearly five months. The NSE benchmark also marked its longest monthly losing streak in 29 years (since 1996), driven by heavy foreign capital outflows amid concerns over U.S. tariffs. The BSE Sensex plunged 1,414.33 points (1.90%) to close at 73,198.10, after hitting an intraday low of 73,141.27,

of only 0.82%. This decline was majorly driven by global economic worries, foreign investors pulling out funds, and disappointing corporate results. Small and mid-cap stocks faced heavy selling pressure. On February 28, 2025, the Indian equity market saw a massive erosion of ₹8.2 lakh crore in market capitalization as the Sensex plummeted by 1,414 points to close at 73,198.10, and the Nifty fell by 420 points to 22,124.70. From January down 1,471.16 points (1.97%). Meanwhile, the Nifty 50 extended its losses for the eighth consecutive session, dropping 420.35 points (1.86%) to settle at 22,124.70. Overall, both indices declined by 6% in February. Looking at the sectoral performance, Nifty IT Index suffered the steepest drop, falling by 4.18%, Nifty Auto Index declined by 3.92%, Nifty FMCG Index dropped by 2.62%, and lastly Nifty Bank Index showed some resilience with a decline to February 2025, the total market capitalization of listed companies on the Sensex fell from approximately ₹445 lakh crore to ₹393 lakh crore, resulting in a loss of over ₹50 lakh crore in market capitalization over the first two months of 2025. Thus, while the total erosion from January to February was over ₹50 lakh crore, the specific erosion in February was highlighted by a significant drop of ₹8.2 lakh crore on the last trading day of the month.

In February 2025, global trade wars triggered significant financial market volatility worldwide. The turmoil began when U.S. President Donald Trump announced tariffs on Canada, Mexico, and China, imposing a 25% tax on most imports from Canada and Mexico (excluding energy products) and a 10% duty on Chinese goods. This led to a sharp market reaction, with Asian indices in Hong Kong, Japan, and South Korea dropping by around 2%, while European markets also declined as Canada and Mexico retaliated. The renewed U.S.–China trade tensions, reminiscent of the 2018–2020 disputes, exacerbated global economic uncertainty, raising concerns over slower GDP growth, rising unemployment, Foreign Institutional Investors (FIIs) withdrew substantial funds from Indian markets during the month, driven by global economic uncertainties and shifting investment preferences. According to depository data, FIIs pulled out approximately ₹34,574 crore from Indian equities during the month, while other reports indicated that outflows exceeded ₹46,000 crore by February 27, bringing the total FII outflows for 2025 to ₹1.12 lakh crore. Several factors contributed to this trend, including escalating global trade tensions and concerns over U.S. tariffs, which heightened market volatility. Additionally, Indian equities were perceived as overvalued compared to other emerging markets like China, where lower valuations made investments more attractive. Weak corporate earnings growth in India further discouraged foreign investors, while strong economic indicators and a strengthening U.S. dollar drew capital toward American markets. China also emerged as a favoured investment destination due to its potential for economic recovery. Collectively, these factors led to a significant FII exodus from Indian markets in February 2025. Several domestic economic factors influenced Indian markets in February 2025. Slower GDP growth was a key concern, with India's economy expanding at a lower-than-expected 5.4% in the second quarter of FY25. However, a recovery to 6.2% in the third quarter, driven by improved rural consumption and increased government spending, provided some optimism. Inflation remained above the Reserve Bank of India's (RBI) comfort level, though strong agricultural output and government interventions helped stabilize food prices. Meanwhile, India's fiscal deficit widened to 74.5% of the revised target for FY25 by January, raising concerns about investor confidence and market stability. Domestic consumption played a crucial role, with robust rural spending supported by a strong agricultural sector, and festival-related demand further boosting economic activity. Additionally, increased government expenditure emerged as a key driver of growth in the third quarter, helping to offset weaker private investment. So in the month of February 2025, the Indian stock markets saw significant declines, extending the bearish trend that began earlier in the year. A key factors behind the downturn was the withdrawal by Foreign Portfolio inflation, and a stronger U.S. dollar. Specific industries faced substantial setbacks, including the automotive sector, where companies like Toyota and Nissan with operations in Mexico saw stock declines, and the technology sector, where Taiwanese firms such as Foxconn and Quanta suffered losses. In India, escalating tariff fears erased $180 billion from market capitalization within two days, with the Nifty Metal Index plunging 5.6% over three sessions due to the trade war’s impact on the metal sector. Overall, February 2025 witnessed heightened economic uncertainty and sector-specific struggles, leaving global markets reeling. Investors (FPIs), global economic uncertainties and sector-specific challenges. Looking ahead to March 2025, several factors are expected to influence market performance. Global trade tensions and volatility in major indices could continue to impact investor confidence, while a potential recovery in GDP growth and the Reserve Bank of India's (RBI) monetary policy stance may provide some support. Government infrastructure spending could further aid economic growth, while sectoral performance remains mixed—Nifty Energy and Metal sectors showed early resilience, whereas challenges persist in Nifty Auto and IT due to global factors and supply chain disruptions. Additionally, continued FII outflows could exert pressure on the market, though domestic institutional investors (DIIs) may offer some stability. Overall, March 2025 is expected to be volatile, with a potential rebound if investor sentiment improves and global uncertainties ease.