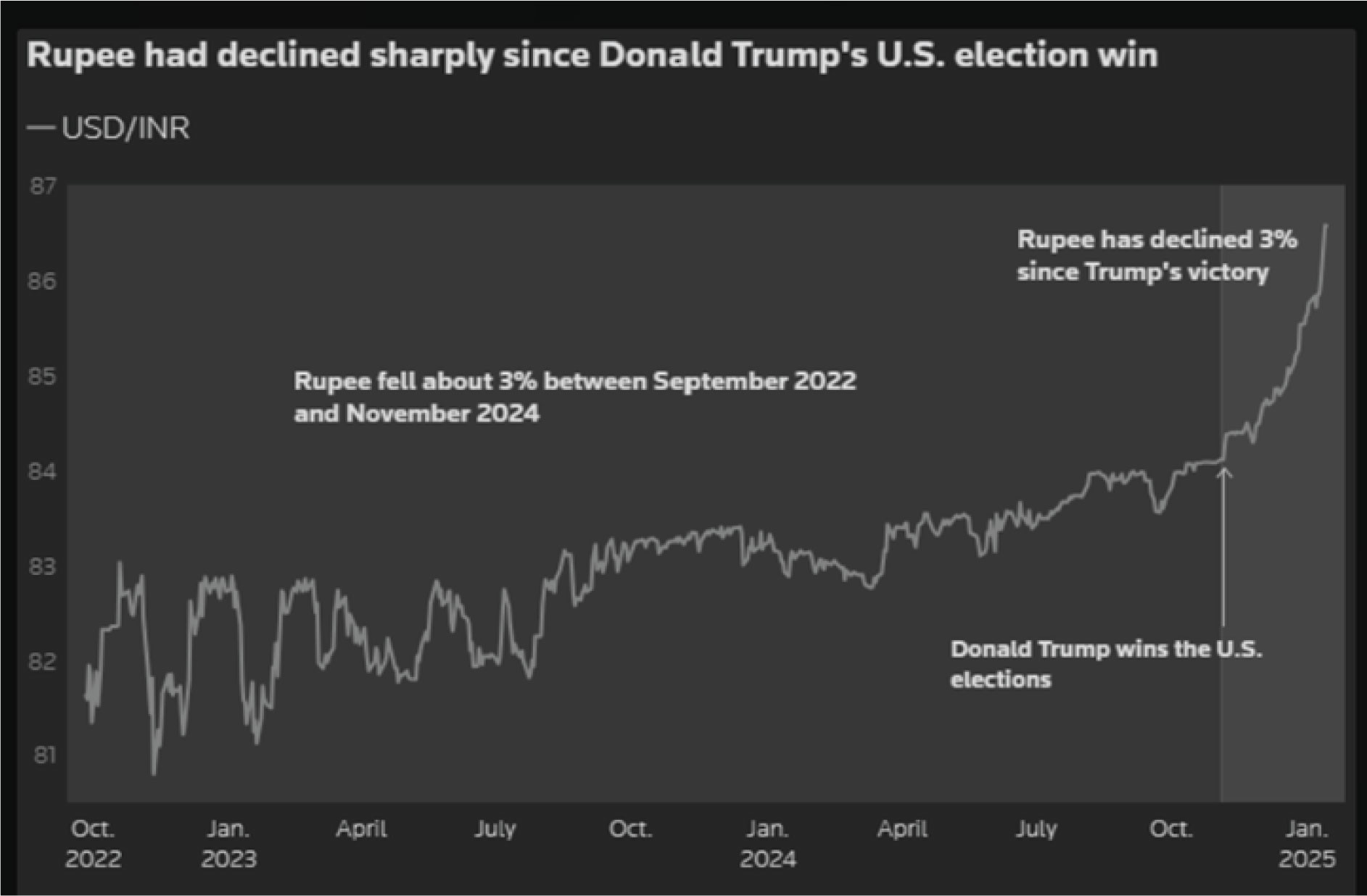

In February 2025, the Indian rupee experienced significant depreciation against the U.S. dollar, reaching an all-time low of ₹88.10 in early February, its weakest level ever. By the end of the month, the rupee had recovered slightly, trading at approximately ₹87.37 per USD, but still marking its fifth consecutive monthly decline. The Indian rupee's depreciation was driven by a combination of global and domestic factors. On the global front, the U.S. Federal Reserve's aggressive interest rate hikes made the U.S. dollar more attractive, leading to capital outflows from emerging markets like India. Geopolitical tensions, particularly the Russia-Ukraine war and trade conflicts, increased global risk aversion, prompting investors to seek safer assets such as the U.S. dollar. Domestically, India's widening trade deficit, fuelled by higher imports of crude oil and essential goods, put additional pressure on the rupee. Slower GDP growth projections and concerns over India's fiscal stability and rising public debt further dampened investor sentiment. Additionally, significant foreign institutional investor (FII) outflows from Indian markets since October 2024 compounded the rupee's weakness. The Reserve Bank of India's decision to allow more flexibility in the rupee's value under Governor Sanjay Malhotra also contributed to the currency's depreciation. Together, these factors led to the rupee's decline in February 2025. The Indian rupee is expected to continue its depreciation trend in March 2025, with potential levels reaching around ₹87 against the U.S. dollar. Key factors influencing the rupee's performance include global economic uncertainties, ongoing trade tensions, and U.S. tariffs, all of which are likely to contribute to volatility in the currency market. Additionally, the Reserve Bank of India's monetary policy decisions and interventions will play a critical role in managing the rupee's fluctuations and mitigating further depreciation