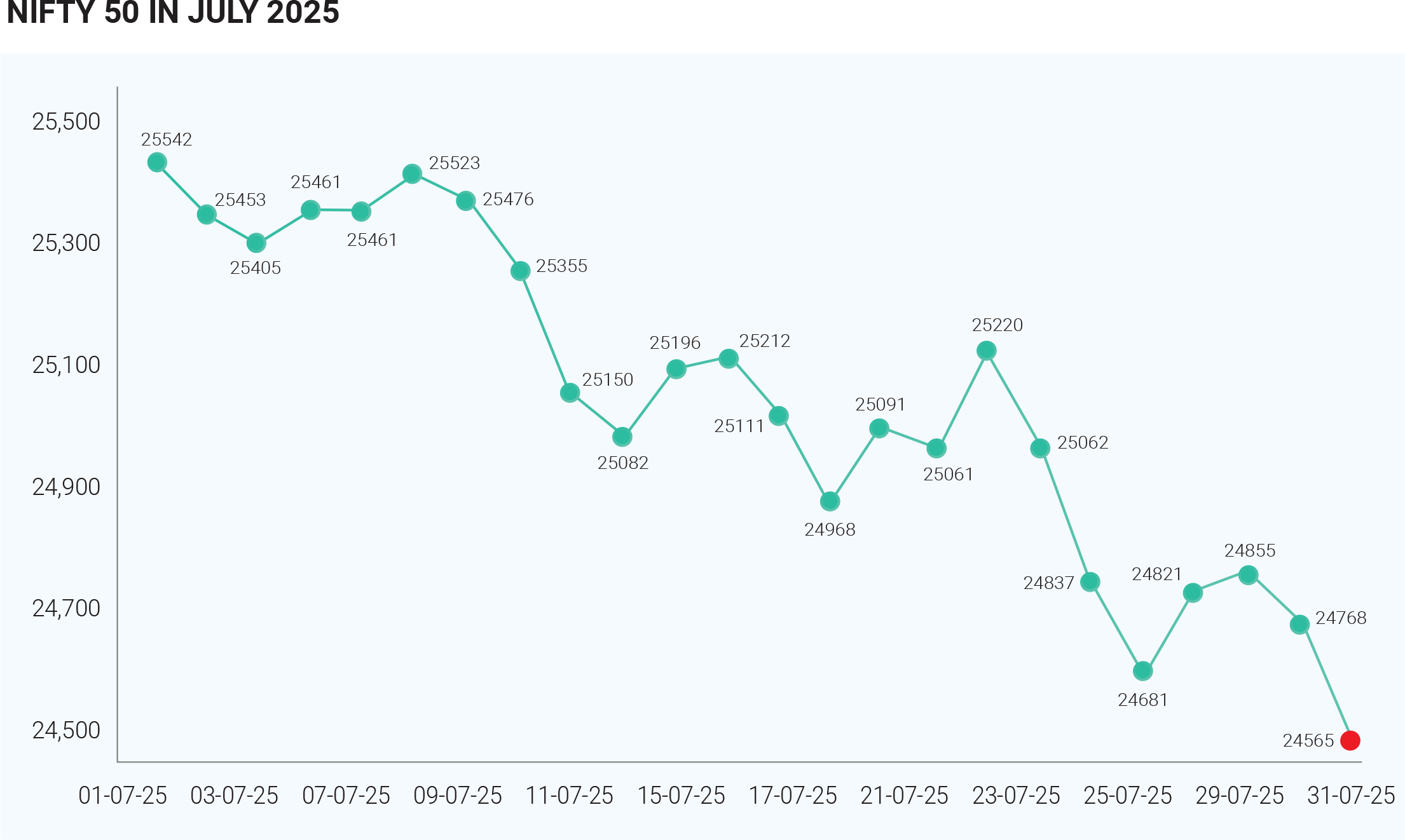

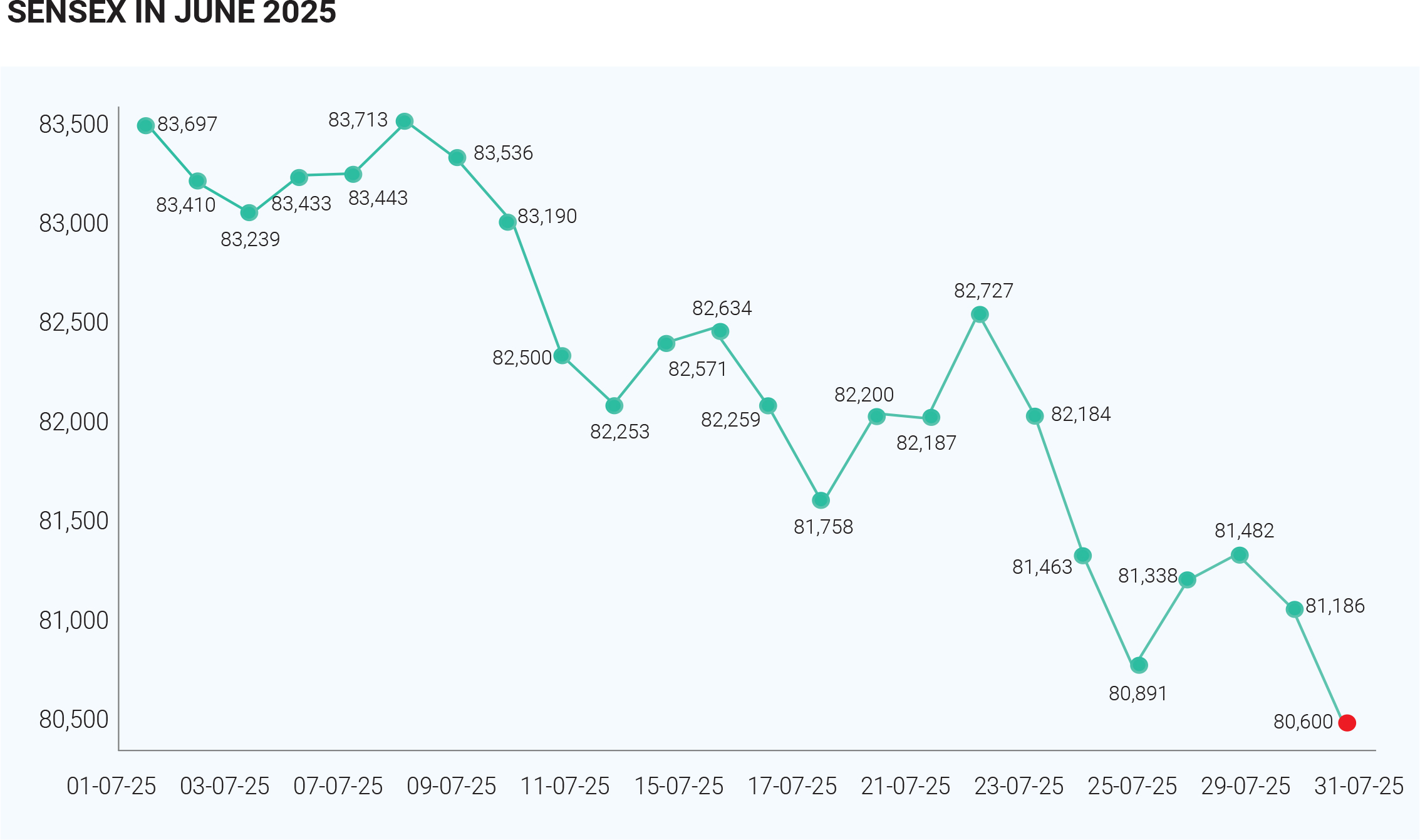

In July 2025, the Indian stock markets witnessed a largely negative trajectory, with the benchmark indices—Nifty 50 and Sensex—registering significant declines over the month. Market sentiment was consistently weighed down by a combination of global trade tensions, foreign fund outflows, mixed corporate earnings, and weakening investor confidence. The broader market mood remained cautious throughout, with periodic rebounds failing to arrest the overall downtrend. From the beginning of July, both the Sensex and Nifty displayed a clear downward trend. Although there were sessions marked by brief recoveries, these were often driven by short-covering or sectoral buying and lacked

the conviction needed to reverse the broader market weakness. The trend remained largely bearish across the month. On July 28, 2025, for instance, the Nifty closed at 24,680, down 0.63%, while the Sensex ended the day at 80,891, down 0.70%, underscoring the sustained weakness in the final trading days of the month. By the end of the month, the losses were evident. On July 31, 2025, the Nifty 50 closed at 24,768.35, down 86.70 points or 0.35% for the day, while the Sensex settled at 81,185.58, declining 296.28 points or 0.36%. Compared to their June closing levels, both indices recorded notable declines, reflecting a consistent erosion of investor confidence throughout the month. The broader weakness in July 2025 can be attributed to several key macroeconomic and sector-specific developments. One of the most impactful was the announcement by the U.S. President of a sweeping 25% tariff on Indian exports. This protectionist move was perceived as a significant threat to India’s global trade competitiveness and triggered widespread selling, particularly in export-linked and cyclical sectors. The policy not only added to global trade tension but also rekindled investor fears of a potential trade war scenario. Adding to the woes was the relentless selling by Foreign Institutional Investors (FIIs), who withdrew over ₹28,500 crore from Indian equities in July. This marked one of the sharpest monthly capital outflows in recent times and significantly impacted market sentiment. While Domestic Institutional Investors (DIIs) stepped in with strong net buying to absorb some of the pressure, their efforts were insufficient to offset the scale of FII withdrawals. This persistent capital flight kept the indices under pressure across multiple sessions. Global cues further exacerbated the negative trend. Asian markets were generally volatile, impacted by concerns over weakening Chinese demand, geopolitical tensions, and an appreciating U.S. dollar. Uncertainty around U.S.-India trade negotiations and conflicting macroeconomic commentary from global financial institutions added to the prevailing risk aversion. Consequently, Indian investors, already grappling with domestic challenges, found little encouragement from the international front. On the domestic front, Q1 FY26 corporate earnings presented a mixed picture. While some sectors like FMCG managed to hold their ground, major cyclical segments such as IT, consumer durables, and auto posted underwhelming results. The negative surprises in these sectors deepened the market correction, as investors reassessed growth expectations. Realty stocks also lagged, facing headwinds from regulatory overhang and funding concerns. Sectoral divergence became a defining feature of July’s market behaviour. Defensive sectors such as FMCG, healthcare, and pharmaceuticals demonstrated resilience. These stocks benefitted from their stable earnings outlook and defensive nature amid rising uncertainty. On the other hand, metals, IT, real estate, auto, and consumer durables were among the worst performers, impacted by global demand concerns, poor earnings, and valuation pressures. Despite the negative backdrop, India’s manufacturing sector offered a rare bright spot. The HSBC India Manufacturing Purchasing Managers’ Index (PMI) climbed to 59.1 in July—its highest reading in 16 months. This pointed to strong underlying domestic demand and industrial momentum. However, even this positive data point was insufficient to lift market sentiment, as broader headwinds from trade tensions and capital market volatility overshadowed domestic resilience. IPO activity, however, remained a pocket of strength. The primary market showed encouraging signs, especially among smaller companies. Thirteen SME IPOs were launched during the month, several of which were oversubscribed, highlighting investor appetite for new listings even as broader markets declined. This enthusiasm suggested that liquidity was still available for select opportunities, although the trend was not strong enough to influence the larger market direction. July 2025 was a challenging month for the Indian stock markets. Both Nifty 50 and Sensex trended lower, reflecting the cumulative impact of global trade disruptions, significant FII outflows, weak earnings in key sectors, and volatile global cues. The announcement of U.S. tariffs on Indian exports acted as a primary drag, triggering a broader re-evaluation of India’s trade prospects and equity valuations. Although the IPO market and select regulatory measures provided glimmers of optimism, they were overshadowed by macroeconomic concerns and capital market pressures. Looking ahead, while domestic growth fundamentals remain intact, the near-term outlook will likely depend on the resolution of global trade issues, the trajectory of foreign fund flows, and clarity on corporate earnings momentum.

In July 2025, the Indian debt market exhibited a generally stable yet cautious performance, reflecting the interplay between supportive domestic fundamentals and a challenging global environment. Throughout the month, bond yields on Indian G-secs and high-grade corporate bonds remained largely range-bound, with longer- onger-duration papers—particularly those in the 30–40 year segment—attracting steady investor interest and trading near 7% yields. This relative stability was underpinned by robust domestic liquidity conditions, especially following the Reserve Bank of India’s (RBI) proactive policy measures. After cutting policy rates by 50 basis points in June and reducing the cash reserve ratio by 1% (infusing roughly ₹2.5 trillion of liquidity), the RBI shifted to a “neutral” stance in July, signalling that further rate cuts were unlikely without a continued and broad-based decline in inflation. Consequently, short-term money market rates, including Treasury Bills and AAA PSU Commercial Papers and Certificates of Deposit, softened appreciably, making shorter-duration instruments particularly attractive to investors seeking safety and liquidity amid global volatility. Domestic investor participation remained firm, with balanced allocations between short and medium-duration funds, though foreign portfolio flows into Indian debt stayed tentative. A major influence on investor behaviour was the evolving global monetary policy landscape, led by the US Federal Reserve’s decision to pause additional rate cuts and signal only a modest reduction in the coming year, rather than the previously anticipated 50 bps easing. This decision kept US Treasury yields elevated, with the 10-year note remaining in a 4.26–4.5% range. The narrowing of the yield spread between US Treasuries and Indian government bonds to well below long-term averages made Indian debt comparatively less attractive to foreign investors on a risk-adjusted basis. As a result, foreign portfolio flows into Indian bonds, which had modestly rebounded in June after earlier outflows driven by trade tensions and global market volatility, remained subdued and highly sensitive to any shifts in US rate expectations. Geopolitical factors also played a significant role in shaping sentiment. Ongoing tensions in the Middle East, especially the escalation in the Iran-Israel conflict, fuelled spikes in crude oil prices and created uncertainty about the stability of global energy supplies. Although domestic inflation remained generally under control in July, markets remained vigilant for any signs of imported inflation pressures and the potential impact on the RBI’s policy stance. This caution kept longer-tenor yields from falling meaningfully despite comfortable liquidity conditions. Additionally, the aftershocks of the Russia-Ukraine war continued to reverberate through global commodity and currency markets, reinforcing a backdrop of risk aversion among international investors. On the domestic front, the fiscal picture improved and offered a degree of reassurance to market participants. India’s fiscal deficit showed signs of narrowing, with policymakers emphasizing discipline and a clear trajectory toward reducing the government debt-to-GDP ratio over the medium term. This commitment was welcomed by credit rating agencies and investors alike, as it suggested that the supply of government securities could be more contained in the coming quarters, thereby supporting yields and anchoring inflation expectations. Even so, the positive impact of these structural improvements was partly offset by lingering global concerns, including downgrades in the US sovereign credit rating and mounting worries about the fiscal health of other large developed economies. Such developments contributed to volatility in global bond and currency markets, indirectly influencing India by raising the required risk premiums on emerging market debt. Domestic institutional investors focused on the front end and belly of the curve, capitalizing on the softer short-term rates and adequate liquidity. Meanwhile, foreign investors adopted a wait-and-watch approach, closely monitoring US Treasury movements, crude oil price trends, and evolving geopolitical risks before increasing their allocations. On the shorter end of the curve, the liquidity support from the RBI’s earlier measures meant that Treasury Bill yields and short-term commercial paper rates remained attractive relative to comparable instruments globally, drawing consistent demand. On the longer end, the combination of global uncertainties and the RBI’s neutral stance kept yields anchored within a narrow band but prevented a more pronounced rally. In the money market, borrowing costs were steady to mildly lower, reflecting the surplus system liquidity and absence of stress in short-term funding. The supportive environment allowed corporates to roll over maturing liabilities without significant pricing pressures, and investors seeking safety found sufficient high-quality paper to deploy funds. However, traders and asset managers remained alert to the potential for sudden repricing in the event of further oil price escalation or an unexpected shift in global rate policy. The Indian debt market in July 2025 was characterized by a delicate balance of supportive domestic trends and formidable external headwinds. While comfortable liquidity, improving fiscal metrics, and controlled domestic inflation provided a stabilizing backdrop, high US yields due to delayed Federal Reserve rate cuts, aggressive monetary tightening by developed economies, and geopolitical disruptions in the Middle East combined to create an atmosphere of caution. Market sentiment remained watchful as participants weighed the prospects of further global dislocations against India’s resilient macro fundamentals.

In July 2025, the Indian Rupee experienced a steady depreciating trend against the US Dollar, reflecting a combination of global and domestic pressures. The exchange rate, which began the month at around ₹85.64 per USD, gradually weakened and ended the month in the range of ₹86.50–₹86.75. This decline of approximately 1–1.2% marked the rupee’s lowest level since mid-March 2025. Daily fluctuations within this range were observed, but the overall direction of movement pointed clearly toward a weaker rupee amid sustained external headwinds and capital outflows. One of the primary drivers of the rupee’s decline was the continued strength of the US dollar. The Federal Reserve’s decision to pause interest rate cuts and maintain elevated rates for a longer period bolstered the dollar’s value globally. Strong US macroeconomic indicators, including solid employment figures and resilient consumer spending, further reinforced the dollar’s appeal among global investors. This strength, in turn, put downward pressure on emerging market currencies, including the Indian Rupee, which became relatively less attractive in a high-yield dollar environment. Foreign institutional investor (FII) outflows also significantly influenced the rupee’s trajectory in July. Indian equity markets saw net FII selling of over $1.5 billion during the month, primarily due to global risk aversion and concerns around trade policy. In the debt segment, portfolio flows remained cautious, with investors closely watching global monetary trends and India’s policy responses. Trade tensions added another layer of pressure. The announcement by the US government regarding potential tariffs of 20–25% on Indian exports raised alarms about the future of bilateral trade relations. This development not only rattled equity markets but also weighed heavily on currency sentiment, with concerns about India’s export competitiveness and trade balance prompting further rupee weakness. Market participants feared that any slowdown in exports would worsen the current account situation, thereby impacting the broader macroeconomic outlook. Rising crude oil prices were another key contributor to the rupee’s depreciation. Escalating geopolitical tensions in the Middle East, especially involving Iran and Israel, drove global oil prices higher. Rising oil prices also create inflationary pressure, which can constrain monetary policy flexibility and affect investor sentiment. These inflationary concerns further dented confidence in the rupee’s near-term prospects. Despite these headwinds, India’s domestic economic indicators offered some resilience. The country recorded strong manufacturing growth, evidenced by the HSBC India Manufacturing PMI rising to a 16-month high. Additionally, fiscal indicators showed improvement, with a narrowing deficit and government commitment to long-term debt reduction. However, these positives were largely overshadowed by short-term global challenges, including capital outflows, geopolitical instability, and trade uncertainty. Investors prioritized risk management over macro fundamentals, thereby limiting the rupee’s support from domestic strength. In response to the mounting volatility, the Reserve Bank of India (RBI) stepped in selectively to stabilize the rupee. While not engaging in aggressive intervention, the central bank likely sold dollars during periods of intense pressure to smooth out excessive currency fluctuations. RBI’s actions were aimed at curbing panic selling while conserving foreign exchange reserves, especially in a backdrop of uncertain external conditions. The central bank’s presence in the market helped limit extreme volatility but could not fully arrest the rupee’s weakening trend due to the broader strength of the dollar and persistent outflows. Overall, the Indian Rupee’s depreciation in July 2025 was driven by a confluence of factors: the firm US dollar, steady capital outflows from equities, concerns over potential US tariffs on Indian exports, rising oil prices, and inflation risks. While the RBI’s calibrated interventions helped manage sharp movements, global macroeconomic uncertainties and geopolitical tensions continued to dominate market sentiment. Despite relatively sound domestic economic indicators, external pressures overwhelmed the currency, keeping it on a weaker footing throughout the month. As investors look ahead, the rupee’s trajectory will likely depend on how global monetary policy evolves, whether geopolitical risks escalate, and how trade negotiations between India and its key partners unfold.

In July 2025, crude oil prices displayed a mildly downward trajectory with intermittent volatility, driven by a complex mix of geopolitical developments, production-related decisions, and evolving global demand signals. By the end of the month, Brent crude had settled around $69.68 per barrel, West Texas Intermediate (WTI) hovered near $66.71, and India’s crude oil basket was priced approximately at $74.82 per barrel. These levels reflected both market caution and a rebalancing of supply-demand expectations as new geopolitical and economic factors emerged. One of the key influences on oil price movement during the month was geopolitical tension, particularly concerning Russia and the Middle East. Early in July, US President Trump issued a 50-day ultimatum to Russia regarding the Ukraine conflict. Ongoing instability in the Middle East—especially due to escalating Iran-Israel hostilities—and renewed threats of US secondary sanctions on buyers of Russian oil continued to support a cautious risk premium in prices. These unresolved tensions sustained an undercurrent of supply concerns, keeping market participants wary of potential disruptions despite the absence of major supply shocks during the month. On the production side, the OPEC+ group remained a central focus. In early July, the alliance of oil-producing nations announced plans to increase output by approximately 548,000 barrels per day starting in September. This decision was seen as an effort to meet expected future demand but also signalled the possibility of a supply surplus later in the year. As markets digested this upcoming production hike, it placed downward pressure on prices toward the end of the month, particularly as global economic signals appeared mixed. OPEC+ compliance levels and coordination between leading producers such as Saudi Arabia and Russia were closely watched by investors, influencing both sentiment and price expectations. Meanwhile, US crude oil inventories showed a notable drawdown in July, suggesting tighter short-term domestic supply and lending some fundamental support to global oil prices. However, robust US oil production and strong refining activity during the peak summer demand season helped balance the equation. Still, the overall sentiment leaned bearish as markets looked beyond the summer, factoring in forecasts from the International Energy Agency that pointed to a potential supply surplus later in 2025 as production outpaces consumption. Adding to the downward pressure was the impact of newly announced US tariffs, including those on imports from countries like India, set to take effect in August. These trade measures raised concerns about global economic growth, indirectly weighing on oil demand expectations. Investors feared that protectionist policies could dampen trade flows, reduce industrial activity, and ultimately lead to slower growth in oil consumption worldwide. To summarise, crude oil prices in July 2025 were shaped by a delicate balance of geopolitical risks, regional disruptions, planned production increases, and mixed signals from demand and inventory data. While supply fears provided intermittent support, the overarching narrative leaned toward price softening due to anticipated production expansion and growing concerns over global economic momentum.

In July 2025, bullion prices—particularly gold—exhibited a consistent upward trend, driven by a combination of strong domestic demand, central bank activity, geopolitical uncertainties, and global economic developments. The price of 24-carat gold in India rose from approximately ₹9,847 per gram at the start of the month to around ₹10,011 per gram by the end, marking a notable increase of about 4%. Similar trends were observed across other gold variants such as 22-carat, 18-carat, and 14-carat, indicating broad-based bullishness in the bullion market. Strong retail and institutional demand played a crucial role in supporting gold prices throughout the month. With ongoing concerns over inflation and market instability, investors increasingly turned to gold as a store of value. This was reflected in steady purchases in both physical and digital gold formats across India. Seasonal and festive buying, coupled with jewellery demand, also added to upward pressure on prices. India’s central bank, along with several emerging market peers, continued its gold-buying spree to diversify foreign exchange reserves and reduce dependency on the US dollar. This strategic accumulation of bullion not only stabilized domestic markets but also lent global support to gold prices. Additionally, a rise in gold imports in India ahead of the festive season created strong physical demand, adding to price momentum. On the global front, gold prices benefited from increased risk aversion among investors. International gold futures saw modest gains, driven by a range of economic and political uncertainties. Notably, the announcement in mid-July of a US base reciprocal tariff hike—from 10% to 15%—on goods from several nations raised concerns about a potential global trade war. This announcement briefly pushed international gold prices above $3,400 per ounce, highlighting bullion’s role as a hedge against rising global uncertainty. Continuing conflicts in the Middle East, particularly the Israel-Gaza situation, along with the prolonged Ukraine war, maintained a high level of geopolitical risk. These tensions contributed to persistent demand for safe-haven assets like gold, keeping its appeal intact even amidst other market developments. In India, the weakening of the rupee against the US dollar further elevated local gold prices. The currency effect, combined with already rising global prices, significantly influenced gold pricing dynamics in the Indian market. Despite a relatively strong US dollar, bolstered by cautious Federal Reserve policy and trade optimism, gold remained resilient. Central banks in developing nations continued their diversification strategies, reinforcing gold’s upward trajectory. Meanwhile, speculative trading around major policy announcements and tariff updates introduced short-term volatility, with prices briefly spiking above $3,400/oz before pulling back later in the month. Bullion prices, particularly gold, rose steadily in July 2025, underpinned by robust domestic and institutional demand, aggressive central bank buying, geopolitical uncertainty, and tariff-related trade concerns. Additional factors such as a weakening rupee, inflationary pressures, and speculative market behaviour also played critical roles. Collectively, these elements reinforced gold’s safe-haven status and ensured it remained a favoured asset class in a turbulent global economic environment.

n July 2025, the Indian mutual fund industry witnessed several significant developments, both regulatory and market-driven. On July 18, the Securities and Exchange Board of India (SEBI) released a set of proposed changes aimed at reshaping mutual fund offerings. A key recommendation was to allow asset management companies (AMCs) to operate both value and contra funds, as long as their portfolio overlap does not exceed 50%. This marked a departure from the earlier rule that restricted AMCs to offering only one of the two. SEBI also opened discussions on whether equity mutual funds should be permitted to diversify their uninvested assets into instruments like debt, gold, silver, and real estate investment trusts (REITs). The regulator has invited public feedback on these proposals until August 8, 2025. In terms of market performance, July saw international mutual funds outperforming their domestic counterparts by a significant margin, with some global funds delivering returns of up to 10%. Sectors such as pharmaceuticals and healthcare were especially strong, reflecting global investor interest in these areas. This trend highlighted a growing appetite for international diversification among Indian investors. Despite this outperformance, the broader domestic equity market faced headwinds. Foreign Portfolio Investors (FPIs) were net sellers throughout July, particularly in equities, amid growing trade tensions and tariff uncertainties between India and the United States. This negatively impacted market sentiment, leading to a decline of 3–4% in major indices. A notable trend was the increasing penetration of mutual funds into smaller, non-metro (B-30) cities. This was driven by digital initiatives, enhanced investor education, and more accessible investment thresholds. Overall, July 2025 represented a phase of structural change and expansion in the Indian mutual fund industry. From SEBI’s progressive proposals to shifts in investor behaviour and global fund outperformance, the month underscored a broadening and deepening of the market

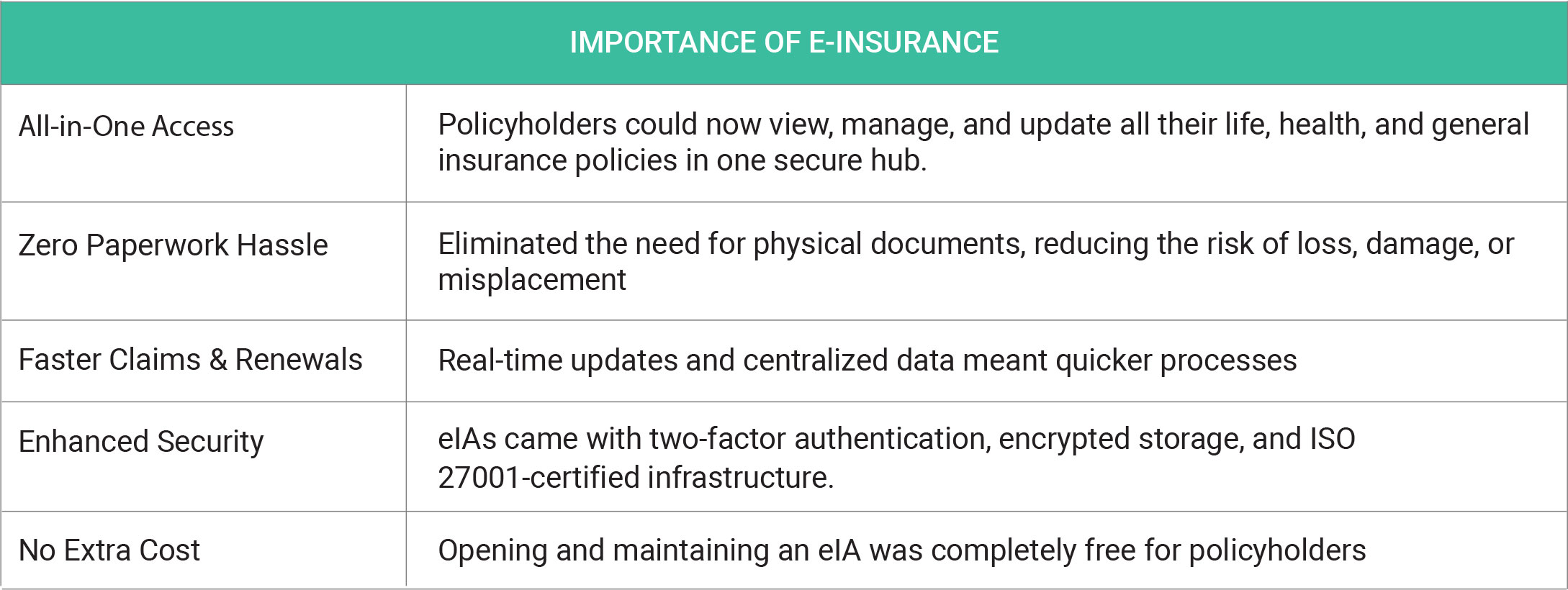

In June 2025, India’s life insurance industry recorded a robust 13% rise in premiums, signalling a strong revival after a phase of subdued growth. This upturn was largely fuelled by private insurers, whose new business premiums (NBP) surged by 16.6%, while LIC also posted a solid 10–11% increase. The industry collected over ₹30,463 crore in new business premiums in May, reflecting strong revenue growth despite a 10.4% decline in policy count—largely due to new surrender value norms introduced in October 2024. Private insurers led the momentum, with standout performers like HDFC Life and SBI Life reporting 33% and 25% premium growth, respectively. This shift highlights intensifying competition and evolving marketdynamics. The growth was primarily driven by group single premium products, which grew 13% year-on-year, while individual policy sales remained muted. LIC maintained steady performance, reporting an 11% rise in total premiums and a 21% increase in annualized premium equivalent (APE), although its retail APE saw a decline—signalling its reliance on group business for growth. The implementation of mandatory e-insurance in June 2025 marked a transformative shift for Indian policyholders, bringing insurance into the digital age with tangible benefits: Despite the impact of regulatory changes on product

mix and policy volumes, the overall industry trend remained positive. The premium surge, driven by private sector strength and innovation, sets a constructive outlook for the remainder of FY 2025–26.

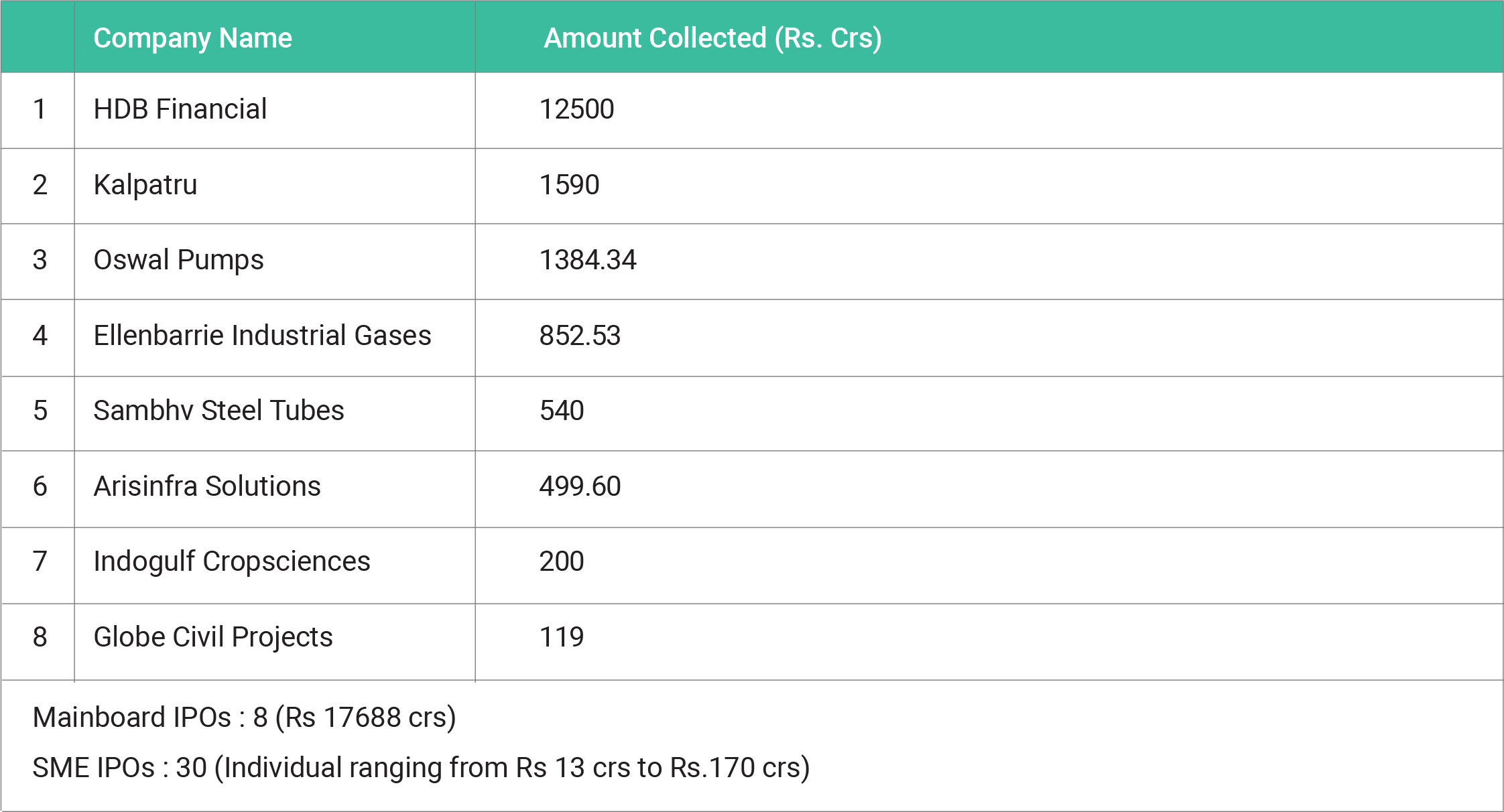

In June 2025, India saw a total of 8 mainboard IPOs and 30 SME IPOs launched, with the mainboard IPOs collectively raising ₹17,688 crore, the highest monthly fundraising in six months. SME IPOs also contributed significantly, with 30 launches in June, each typically raising between ₹13 crore and ₹170 crore. This surge in IPO activity was driven by strong retail participation and favourable market sentiment. Below are the mainboard IPOs launched in June 2025 and their respective amounts collected:

Copyright © 2021 Fintso