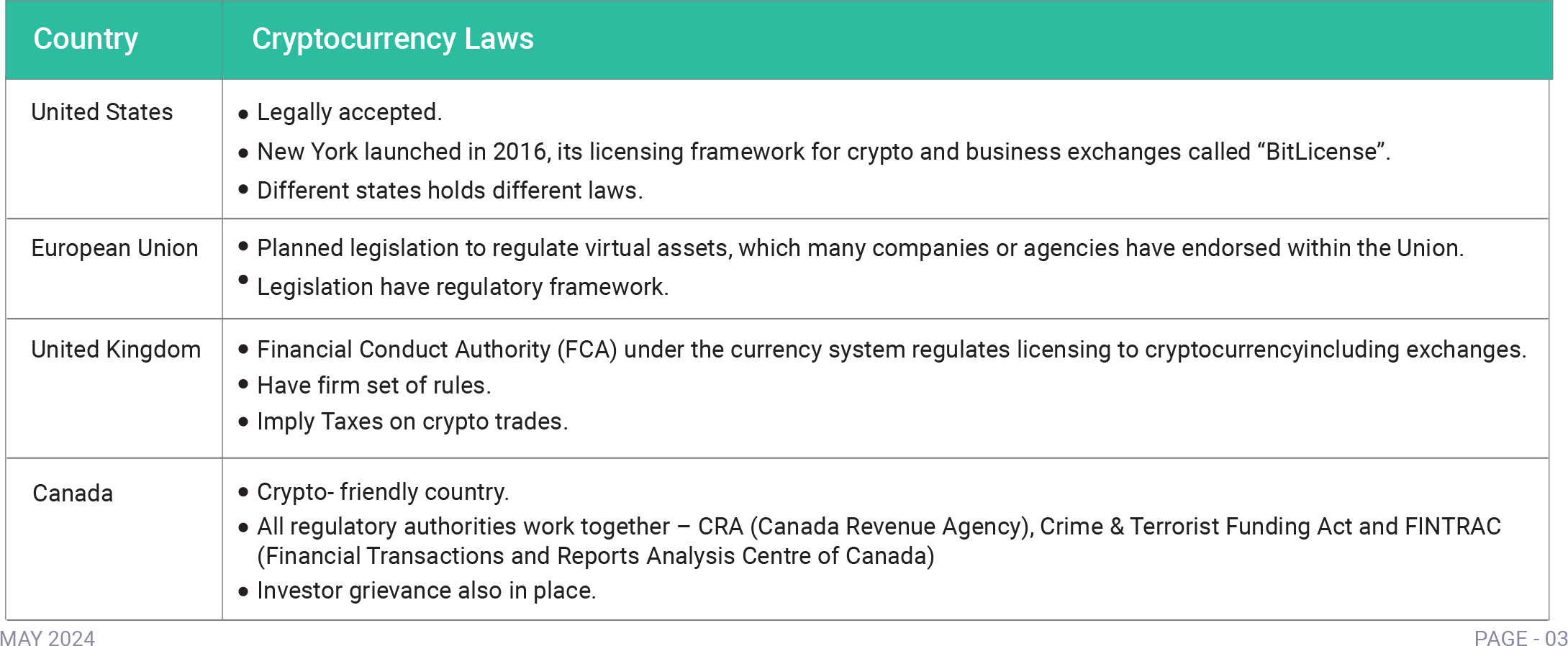

In a joint operation on 27th April, Indian and US authorities cracked down on a major drug trafficking ring that used cryptocurrency for transactions. The Enforcement Directorate (ED) and the Federal Bureau of Investigation (FBI) collaborated on raids in Uttarakhand's Haldwani district, seizing over $360 million in digital currency (crypto) linked to the drug operation. The investigation began in August 2023 based on a tip from the FBI regarding two suspects involved in international drug trafficking. These suspects allegedly sold drugs through online advertisements and dark web vendors, accepting crypto payments. This case highlights the growing concern around cryptocurrency-facilitated crime, particularly in smaller cities of India. As India's crypto market flourishes, regulations are still under development. Cryptocurrency is a digital asset secured by a vast network of computers. Unlike traditional currencies, it operates outside the control of central banks or governments. Introduced in 2021, the Cryptocurrency and Regulation of Official Digital Currency Bill aimed to establish a framework for a government-issued digital currency by the Reserve Bank of India (RBI). However, its passage has been delayed, with the Ministry of Finance raising concerns during the current parliamentary session. The debate surrounding cryptocurrency's legality and benefits continues globally. While some countries embrace its decentralised nature, others remain cautious. Regulations aimed at countering money laundering and terrorism financing (AML/CFT) may be implemented by some nations to limit its misuse for such purposes.

Several countries have banned cryptocurrency

altogether, including China, Bangladesh, Egypt, Morocco,

Nepal, Iraq, Tunisia, and Qatar. While India doesn't

currently have a law in place specifically banning crypto,

the Cryptocurrency Bill 2021 is still under development.

In the meantime, the government has begun taxing

virtual assets as part of the 2022 Union Budget

Few terminologies of Cryptocurrency world: FUD (fear, uncertainty & doubt) : A strategy used to influence people’s perception of crypto through the spreading of negative, misleading or false information. Halving : It is a process that reduces the number of new coins created in a cryptocurrency’s blockchain. Mining rigs : They are specialized computers, customized for cryptocurrency mining. A miner is used to help process transactions and secure the network of a cryptocurrency that uses a Proof-of-Work algorithm. When Lambo : the point at which crypto holders will be rich enough to buy a Lamborghini. Flash Crash : When the price of an asset drops drastically in a short period of time and then returns to the previous levels in the same amount of time.

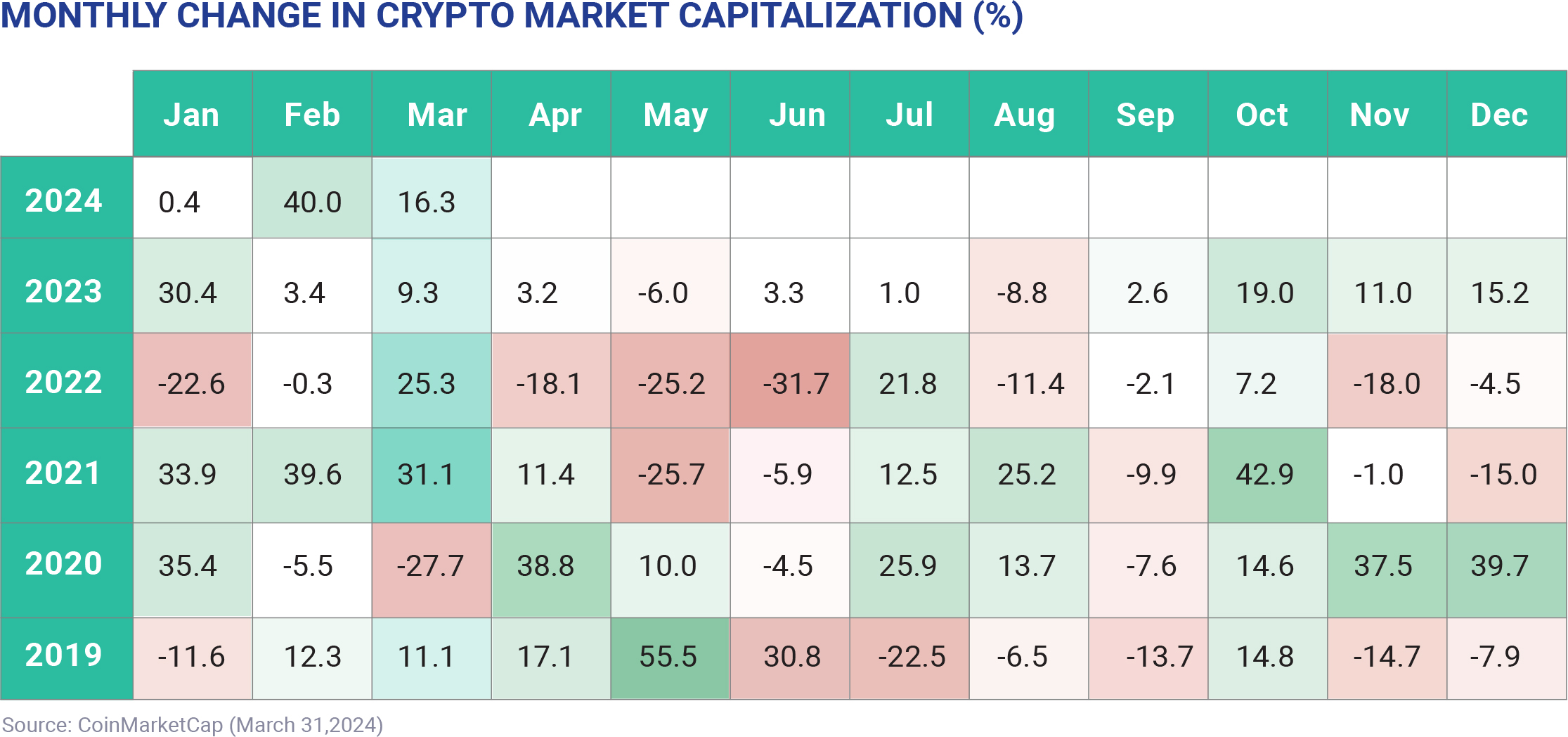

A 2023 report found that millions of Indian crypto users (3-5 million) have switched to foreign exchanges, taking $3.8 billion in trading volume with them. This shift is attributed to India's high crypto taxes (1% TDS and 30% capital gains tax with no loss offsetting). To effectively regulate crypto, policymakers need to recognize it as a financial asset.